Italian patent box regime: a new opportunity

Just released the Italian patent box. It represents a huge potential tax saving relief eligible for a very large number of resident and foreign companies in Italy.

The 2015 Financial bill (DdL Stabilità 2015) approved by the Italian Parliament On 22 December 2014 introduces an elective regime which grants an exemption from corporate income tax (IRES, generally levied at 27.5%) and local tax (IRAP, generally levied at 3.9%) on income derived from qualifying intangible assets (such as patents, know-how and other intellectual properties). The exemption will be equal to 30% for 2015, 40% for 2016 and 50% as of 2017 onwards. The decree was signed on the day of Thursday, July 30, and from the first rumors we can understand the main practical aspects at stake.

The scope of the new regime

With the aim of encouraging the development and exploitation of intangible assets in the Italian territory while also preventing intellectual properties (IP) migration practices, the Italian Government has introduced for the first time a “Patent Box” regime.

Duration

The patent box regime can apply from the first fiscal year that follows the one ongoing as of December 31, 2014t and is characterized by a five year election period, i.e., the election may not be revoked for a period of five fiscal years (FY). The option is renewable.

To enter in the Patent Box Regime taxpayers shall exercise an option. This option can be exercised electronically (more details will be provided in the coming regulation) in the first two fiscal years while in the following years will be exercised in the relating tax return.

In this respect tax payers should pay a particular attention to the modalities and terms provided for exercising the option in relation to the initial two fiscal years, because whether the option must be exercised when these years are still ongoing, with reference to fiscal year 2015 (first possible year of application) the option should be exercised within December 31, 2015.

Beneficiaries

The Patent Box can be claimed by entities deriving taxable business incomes in Italy (both Italian and foreign taxpayers). It follows that foreign taxpayers will be given access to the benefit only if they carry on their business in Italy through a permanent establishment. Further, foreign taxpayers shall be resident in countries having a Tax Treaty and an exchange of tax information agreement in force.

Only taxpayers involved in qualifying research and development (R&D) activities may be admitted to the Patent Box regime. However it is allowed that such R&D activities may be also outsourced to any third party (i.e. unrelated party such as universities, research entities etc.) or to related entities (i.e. intra-group).

Income exempted

The optional regime grants a partial exemption for both corporate income tax (IRES) and regional tax (IRAP) purposes to Italian companies and to Italian branches of nonresident companies on income derived from the licensing or the direct exploitation of intangibles.

The election grants an exemption of 50% of the qualifying income and applies starting from the first fiscal year that follows the one ongoing as of December 31, 2014. However, for the FYs 2015 and 2016, the exemption is capped at 30% and 40% respectively. The 50% exemption should apply starting from 2017 onwards.

Accordingly, following the introduction of the provision under discussion the effective main tax rate for income streaming from intangible assets will be reduced to 15.7% (compared to the standard rate of 31.4%).

Qualifying income: the OECD “Nexus Approach”

The Italian Patent Box regime follows the “Nexus Approach” as discussed by the Organisation for Economic Co-operation and Development (OECD) in its interim report of September 16, 2014 on countering harmful tax practices in connection with Action 5 of its Action Plan on Base Erosion and Profit Shifting (BEPS).

On the basis of such approach, the Italian regime determines the qualifying income (on which the 50% exemption is then applied) proportionally to the R&D activities actually performed by the taxpayers. The beneficial regime in fact, is subject to the condition that that the taxpayer is actively involved in research and development activities that led to the creation of a qualifying Intellectual Property (“IP”).

As stated above it is possible to benefit from the Patent Box regime only if R&D activities are performed either directly or in cooperation with third parties or related parties as well.

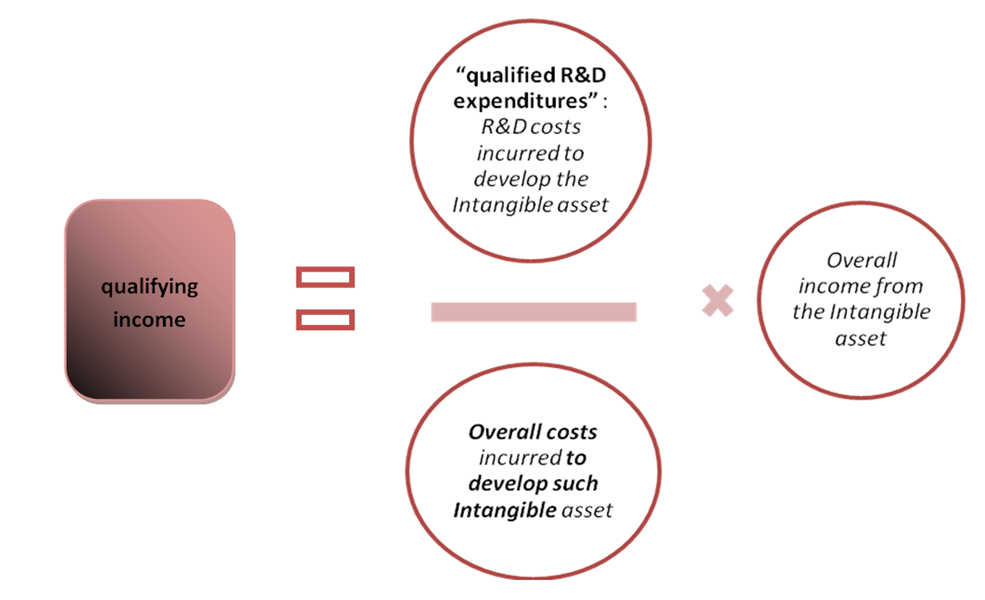

Specifically, the qualifying income is calculated by multiplying the overall income derived from the IP asset by the ratio of “qualifying R&D expenditures” over the “total expenditures incurred to develop the IP.”:

Costs to be considered as “qualified R&D expenditures” at the numerator are, in general terms:

- costs related to R&D activity directly carried out by the taxpayer,

- costs related to R&D activity outsourced to third parties (i.e. unrelated parties),

- costs related to R&D activity outsourced to related entities (i.e. group entities) for the portion consisting of the charge-back of costs incurred by them in relation to third parties,

- costs relating to research and development incurred by the taxpayer under a cost sharing arrangement (CCA) in the limit of the income from charges made to the participants of development costs, maintenance and growth.

Costs to be considered in the denominator as “total costs incurred for the development of the intangible asset” include all the above costs as components of the numerator with the addition of two further typologies:

1. Costs related to R & D outsourced to related entities (ie group entities);

2. Costs related to the acquisition of intellectual property rights.

These last two types of costs are also to be included in the numerator (so called “up-lift”) but only to a limit of 30% of the costs to be considered in the numerator above (i.e. up to 30% of the “qualified R&D expenditures”).

Therefore, considering that this is the only difference compared to the costs to be included in the denominator, in the case the amount of these latter costs is equal to or lower than the abovementioned 30% the ratio of the numerator and the denominator will be equal to 1, with the result that all income could take advantage of the tax relief provided by the standard. In contrast, if the amount of such costs is greater than the before mentioned 30% ratio, the above ratio will prove to be less than 1, and then only part of the income will be able to benefit from the tax reduction.

In the first tax period of effectiveness of the new provision (eg. 2015) and for the next two (eg. 2016 and 2017) the costs to be considered are those incurred during the fiscal period to which the tax return refers to as well as those incurred during the three previous fiscal years, and are considered globally or in other terms without distinction among each intangible asset they refer to.

From the third tax period (eg. 2018) starting from to the entering into effect of the law provisions (eg. 2015), the costs to consider are those incurred in the periods where those provisions are applicable (eg. 2015, 2016, 2017, 2018) and are calculated for each intangible asset.

This provision is justified by the fact that the R&D should be aimed at the maintenance, enhancement and development of intangible assets specific (unless they are complementary to each other in which case they are treated as one intangible) and in the assumption that to qualify for this scheme the companies will require, from the first year of application of the above rules (eg. 2015), a proper system of traceability of the research and development costs for each individual intangible asset.

Qualifying intangible assets

Intangible assets typologies taken into account for the Italian Patent box regime are very broad.

The discounted tax rate may apply to software protected by copyright, patents (granted or under granting procedure), any kind of trademarks (including purely commercial trademarks), Know-how, designs and models capable of legal protection, and know how and other business information legally protectable. For company information a certification seems to be required by a public body identified with special decree of the Ministry of Economic Development.

Each IP should be considered separately. If two or more intangible assets are connected by a bond of complementarity such that the finalization of a product or a process is subject to the use of the same joint these may qualify as a single asset for the application of the patent box regime. Implementing regulations will be issued to provide some clarifications and make the regime fully applicable.

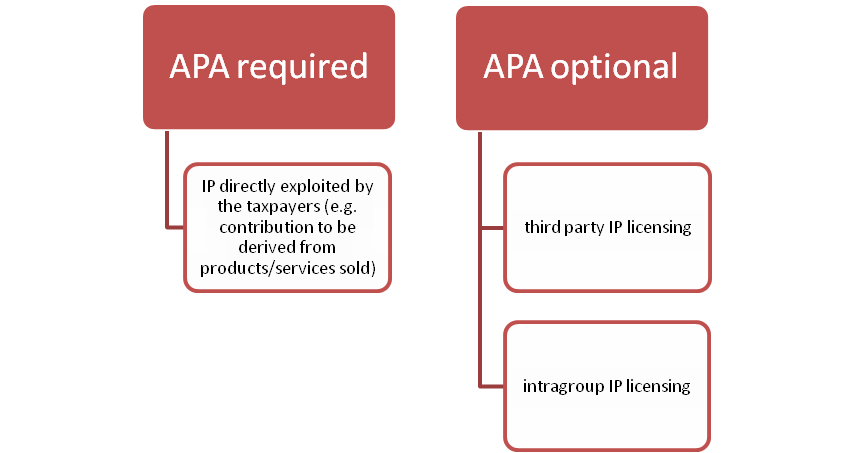

Advanced Ruling agreement procedure

An advanced ruling (Advanced Pricing Agreement with the Italian Revenue Agency (hereinafter “APA”), according to Article 8 of Law Decree n. 269, dated September 30th, 2003 is specifically required to determine the economic contribution (i.e. the figurative income) attributable to the qualifying IP when it is directly exploited by the taxpayers (i.e. in case the IP is not licensed, but for example the attributable income is encompassed in the selling price of a product). The ruling procedure is not specifically requested i) in the case of intragroup IP licensing and ii) third party party IP licensing. However, tax payer may apply for the ruling in order to have more certainty on the application of the patent box regime.

However for the purposes of determining the economic contribution attributable to the intangible asset in the case of direct use of the same, micro, small and medium-sized enterprises (as defined in the European Commission Recommendation 2003/361 / EC) may use simplified procedures for access to the said Ruling (modalities will be determined by specific measure to be issued by Italian Revenue Agency). The contribution will still have to be determined on the basis of international standards recognized by the OECD, with particular reference to the transfer pricing guidelines.

These companies should in any case be able to provide evidence to tax authorities on the nexus between the expenses and the relating income.

Capital gain exemption

Furthermore, capital gains from the disposal of the qualifying intangibles are 100% exempt from taxation provided that at least 90% of the related consideration is reinvested by taxpayers for the development of similar IPs by the end of the second FY following the year of the disposal.

When the transfer occurs in favor of related parties the gain can be determined through the procedure of International Ruling.

Contact us for specific assistance on the Italian Patent Box.

I testi e l’elaborazione dei testi, anche se curati con scrupolosa attenzione, non possono comportare specifiche responsabilità per involontari errori e inesattezze. / The contents of this article, even if treated with scrupulous attention, can not involve specific responsibility for inadvertent errors and inaccuracies.

Leave a comment